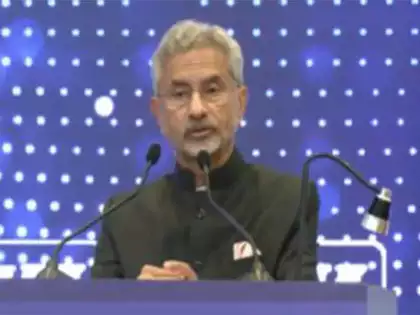

India and China have recently finished pulling back their soldiers from the last two spots where they faced each other on their Himalayan border. This is a big step toward improving their relationship. India’s Foreign Minister Subrahmanyam Jaishankar said that now both countries will start to think about other parts of their relationship carefully.

The two countries have had a tough time since the 2020 clashes, where 20 Indian and 4 Chinese soldiers lost their lives. Since then, India has cut off direct flights to China, banned many Chinese apps, and increased checks on Chinese investments. India believes that their relationship can’t get better unless there is peace at the border.

On the other hand, China thinks that the border issues shouldn’t stop them from having a good relationship. Jaishankar mentioned that with the end of the troop pullback, they can start looking at other ways to work together, but they need to keep their national safety as the main priority.

He also mentioned that making sure there is peace and calm at the border is very important for both countries to grow closer. Soon, top officials and diplomats from both sides will meet to discuss how to keep things peaceful and manage their activities at the border.

The border that stretches for about 4,000 km (around 2,500 miles) has caused tension for many years and even led to a war in 1962. After some earlier talks and agreements, things got better until the conflicts in 2020 interrupted their business ties.

Not long after they reached an agreement to end the border dispute, Chinese President Xi Jinping and Indian Prime Minister Narendra Modi talked for the first time in five years and decided to work on their differences and strengthen their ties. Indian officials believe that while they want to improve their business relationship, they will proceed slowly because there is still a lack of trust from the past years. The first steps may include restarting direct flights and speeding up visa approvals.