The Tamil Nadu Hindu Religious and Charitable Endowments Department has said no to a man who wanted his iPhone back after it accidentally fell into a donation box at the Sri Kandaswamy temple. The phone is now considered the temple’s property.

Dinesh, the man who lost his phone, was trying to make a donation when the phone slipped from his hand. After finding out the phone was in the donation box, he asked temple officials to give it back. However, they told him he could only retrieve the data from it, not the phone. Dinesh was not happy with this answer and wanted his phone back.

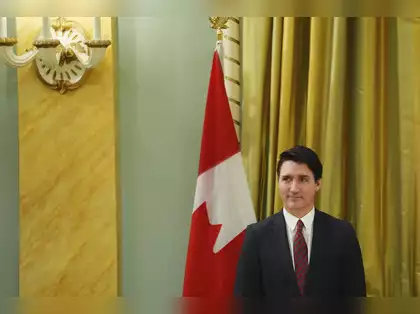

HR and CE Minister P K Sekar Babu responded to this situation by saying that anything that goes into the donation box belongs to God. He explained that all donations are considered offerings to the deity of the temple. Therefore, the rules say they cannot return any items dropped in the donation box.

He mentioned he would talk with department officials to see if they could help Dinesh in some other way.

This isn’t the first time something like this has happened. In May 2023, a woman named S Sangeetha dropped her gold chain into a donation box at the Sri Dhandayuthapani Swamy temple in Palani. After checking the security footage and seeing the chain fell by accident, the temple chairman bought her a new gold chain to help her out.

According to the temple rules set in 1975, anything put into the donation boxes belongs to the temple and cannot be returned to the owner.