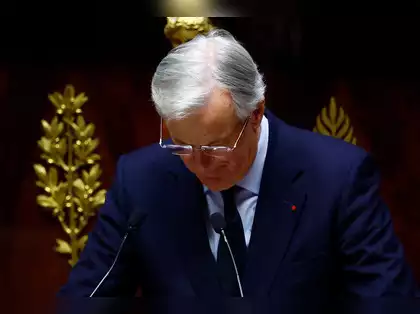

France’s government, led by Prime Minister Michel Barnier, is in serious trouble. Lawmakers from both the left and the far-right are planning to vote against him in parliament. This vote, which will take place on Wednesday, might lead to Barnier’s Cabinet being the shortest in modern French history. If the vote passes, President Emmanuel Macron must choose a new prime minister.

So why is everyone so upset? After recent elections, France’s parliament is split into three main groups: the New Popular Front (a left-wing group), Macron’s centrist party, and the National Rally (far-right). None of these groups has a clear majority, which makes it hard to pass laws.

In September, Macron asked Barnier, a conservative, to form a government mainly with Republicans and centrist members. However, the far-right leader, Marine Le Pen, is now saying her party will support the vote to remove him, saying Barnier is not listening to her requests. Meanwhile, the left is unhappy about the government’s proposed budget cuts and lack of communication.

To pass the no-confidence vote, Barnier needs at least 289 votes out of 577. The left and the far-right together have more than 330 lawmakers, but some might choose not to vote. If the government falls, it would be the first time in over 60 years that a no-confidence vote has succeeded in France.

If Barnier’s government collapses, Macron could ask current ministers to handle daily operations until a new prime minister is chosen. The current mix of political parties in parliament would stay the same, and new elections cannot happen until July because of laws that protect the National Assembly.

As for the budget, France won’t face a government shutdown like the US might. If the government falls, it can still present a special law to collect taxes and continue paying civil servants and pensions using existing rules. However, this would stop any new taxes or spending.

Markets are worried because Barnier has warned of potential chaos in the financial world. France is under pressure from the European Union to lower its massive debt, which is expected to hit 6% of the country’s GDP this year and could go to 7% next year if no big changes are made. The instability could lead to higher interest rates, making the debt problem worse. A new government might struggle to implement significant changes without a clear majority.