Reliance Power announced that the Solar Energy Corporation of India Limited (SECI) has lifted a ban on the company. This means that Reliance Power and its subsidiary, Reliance NU BESS Limited (formerly called Maharashtra Energy Generation Limited), can now take part in all SECI tenders. Previously, on November 6, SECI had banned both companies from joining any future tenders for three years. However, after some legal discussions, SECI decided to remove this ban. It’s important to note that SECI still has the right to take legal actions if necessary

Author: Supriya Jena

-

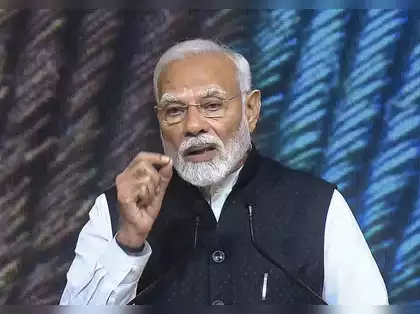

New Bill to Transform India’s Oil and Gas Sector for a Bright Future

Prime Minister Narendra Modi stated on Tuesday that the Oilfields (Regulation and Development) Amendment Bill, 2024, is a key law that will help improve energy security in India and make the country more prosperous. His message came after the Bill was approved in the Rajya Sabha.

This new law aims to change the current rules about exploring and producing oil and gas. It will separate oil operations from mining to encourage more investment in the energy sector. The Bill, which was introduced in August, passed by a voice vote.

Modi praised the law, saying it is vital for boosting energy security and supporting a prosperous India. Oil Minister Hardeep Singh Puri also expressed excitement, saying that India’s fast-growing energy industry took a big step forward with these important changes to the Oilfields (Regulation and Development) Act, originally established in 1948.

-

Amazon Invests ₹450 Crore in New Data Center Near Mumbai!

Amazon India has bought a large piece of land—over 38 acres—in Palava, close to Mumbai, from Lodha, a well-known real estate company. They paid more than ₹450 crore (about $54 million) to build a big data center there. Amazon’s data service branch, Amazon Data Services India, will use the land to create a new facility that can hold up to 4.16 million square feet of space.

So far, Amazon has paid about ₹396 crore to Lodha as part of the deal and will pay the remaining ₹54 crore later after completing some steps. They also paid ₹27 crore for stamp duty to register the purchase on November 12.

Last year, Amazon also leased a smaller 4-acre land in Powai, Mumbai, for nearly 18 years to build another data center, spending more than ₹562 crore in total rent. In 2022, they even leased an extra 5.5 acres from the same company, adding up their total land to 9.5 acres, costing nearly ₹1,500 crore in rent over the years.

Before these deals, Amazon set up a data center in Thane, where they bought a huge 54-acre land for over ₹1,870 crore last year.

Amazon is dedicated to improving digital services in India and plans to spend up to $12.7 billion on cloud infrastructure by 2030. Other big companies like Google and Microsoft are also investing in data centers in India, which are becoming super important for various online services

-

Elon Musk’s xAI: Rapid Rise to a $50 Billion AI Powerhouse

Elon Musk’s company xAI is making waves in the world of artificial intelligence (AI). It reached a huge value of $50 billion just a year and four months after it started in July 2023. This is much faster than other companies like Anthropic, which is worth $19 billion, and Perplexity, worth $2.8 billion.

Big Achievements in a Short Time

– Valuation Milestone: In only 16 months, xAI became worth $50 billion. In comparison, OpenAI took over nine years to reach the same level.

– Funding Success: xAI raised $5 billion in its most recent round of funding. Big investors included Valor Equity Partners, Sequoia Capital, Andreessen Horowitz, and the Qatar Investment Authority.

– Building Powerful Computers: xAI bought 100,000 Nvidia chips to make its supercomputer, called Memphis. This computer can help develop AI technology quickly and supports Tesla’s Full Self-Driving features.

Building a Supercomputer Faster Than Ever

xAI created the Memphis supercomputer in just 19 days on an old factory site. This is incredible because similar projects usually take much longer—around three years to plan and over a year to build. The Memphis facility can hold 100,000 Nvidia GPUs, making it the fastest supercomputer in a single group.

Innovations Making xAI Stand Out

– AI Chatbot Grok: xAI made Grok, an AI chatbot inspired by “The Hitchhiker’s Guide to the Galaxy.” Grok competes with other popular chatbots like OpenAI’s ChatGPT and Google’s Gemini.

– Smart Language Model: Grok runs on xAI’s special Grok-2 language model, which understands natural language very well.

– Training with Real Data: The social media platform X, created by Elon Musk, helps train Grok. It uses real-time user interactions to improve how Grok responds.

xAI’s fast growth shows how smart its strategies are for getting money, building powerful technology, and creating cool products. The company aims to keep expanding its AI skills with more technology investments and improvements.

-

Nifty 50: Axis Securities Predicts Bright Future and Top Stock Picks!

Good news for everyone! The Nifty 50 index has gone up more than 1% in the last two trading days. A company called Axis Securities believes that the index could reach 26,100 by December 2025, which is an 8% increase from where it is now. They think India’s economy is growing strong, thanks to more money being spent on projects, which helps banks lend more. This means that Indian stocks could provide great returns, predicted to be in the double digits over the next 2-3 years.

Axis Securities expects earnings to grow at a strong rate of 14% each year from 2023 to 2027. They see good signs from the economy, government spending on buildings and roads, and a stable political situation. Financial stocks like ICICI Bank and SBI are expected to do really well in 2025 and 2026.

Even though some investors might be looking at China for a little while, Axis Securities is still confident about the long-term prospects of Indian stocks. Their advice? Focus on choosing good-quality stocks at reasonable prices to increase your chances of earning money in the next year.

In the short term, there might be some ups and downs in the market. Axis Securities suggests a “Buy on Dips” strategy. They recommend keeping some cash handy (about 10%) to take advantage of price drops and to invest in high-quality companies that are likely to perform well in the next 12-18 months.

In a nutshell, Axis Securities feels positive about India’s market in the long run, even when the global situation seems unpredictable.

Their top stock picks include:

Financials:

– ICICI Bank (Target Price: Rs 1,500; Upside: 15%)

– State Bank of India (Target Price: Rs 1,040; Upside: 24%)

– HDFC Bank (Target Price: Rs 2,025; Upside: 13%)

– Cholamandalam Investment & Finance (Target Price: Rs 1,675; Upside: 36%)Healthcare:

– Aurobindo Pharma (Target Price: Rs 1,730; Upside: 37%)

– Lupin Ltd (Target Price: Rs 2,600; Upside: 27%)

– Healthcare Global Enterprises (Target Price: Rs 575; Upside: 14%)Consumer Staples:

– Varun Beverages (Target Price: Rs 700; Upside: 13%)Communication Services:

– Bharti Airtel (Target Price: Rs 1,880; Upside: 16%)Information Technology:

– HCL Technologies (Target Price: Rs 2,100; Upside: 14%)Materials:

– Dalmia Bharat (Target Price: Rs 2,040; Upside: 12%)

– Gravita India (Target Price: Rs 3,000; Upside: 38%)Consumer Discretionary:

– Chalet Hotels (Target Price: Rs 1,035; Upside: 16%)

– Sansera Engineering (Target Price: Rs 1,780; Upside: 12%)Real Estate:

– Prestige Estates Projects (Target Price: Rs 2,195; Upside: 33%)Industrial:

– J.Kumar Infraprojects (Target Price: Rs 950; Upside: 26%)So remember, keeping some cash on hand is smart for taking advantage of dips in quality stocks!

-

Sugar Stocks Rally as Nifty and Sensex Climb: Key Winners and Losers

However, some companies lost value. Dalmia Bharat Sugar dropped by 1.30%, and Kothari Sugars fell by 0.69%.

Overall, the Nifty50 index ended the day up by 181.11 points at 24,457.15. The BSE Sensex also performed well, closing up 597.67 points at 80,845.75. Some top gainers in the Nifty pack included Adani Ports (up 6.0%), NTPC (up 2.59%), and Adani Enterprises (up 2.33%).

On Tuesday, many sugar companies saw their share prices go up! Balrampur Chini Mills Ltd. increased by 2.85%, and Bajaj Hindusthan Sugar Ltd. followed closely with a 2.77% rise. Other gainers included EID Parry (up 2.20%), KCP Sugar (up 2.14%), and Uttam Sugar (up 1.78%).

On the flip side, Bharti Airtel fell by 1.41%, and Hero MotoCorp decreased by 1.09%.

-

1.45 Crore Registrations Under PM Surya Ghar Muft Bijli Yojana!

The PM Surya Ghar Muft Bijli Yojana is making waves! Recently, a government report revealed that about 1.45 crore people have signed up for this scheme, and they’ve completed around 6.34 lakh solar panel installations on rooftops. The goal of this project is to set up 1 crore solar rooftops in homes by the year 2027, with a budget of ₹75,021 crores.

According to Union Minister Shripad Naik, the scheme has recorded 1.45 crore registrations and 26.38 lakh applications, with 6.34 lakh solar panels already installed. Such projects aim to help families save on electricity costs and promote green energy.

As of now, the government has issued subsidies to 3.66 lakh applicants, which are processed quickly within 15 to 21 days. When it comes to solar panel installations, Gujarat is leading the way with 2,86,545 installations, followed by Maharashtra with 1,26,344, and Uttar Pradesh with 53,423. The ministry is working closely with various groups like REC, DISCOMs, and vendors to solve any issues that might come up during the project.

This initiative is not just about saving money; it’s about making a cleaner and greener planet for everyone.

-

Gold Prices Fall Again, Silver Surges: Understand the Trends!

Gold prices fell for the second day in a row, dropping by Rs 200 to Rs 79,000 for every 10 grams in the national capital, according to the All India Sarafa Association. On Monday, gold was priced at Rs 79,200 for the same amount.

In contrast, silver prices jumped up by Rs 2,400, reaching Rs 92,400 per kg, up from Rs 90,000. Traders say the rise in silver prices is mainly due to its demand in industries.

Gold with 99.5% purity also dropped by Rs 200, closing at Rs 78,600 for 10 grams, down from Rs 78,800 on Monday. In futures trading on the Multi Commodity Exchange (MCX), gold for February delivery went up by Rs 146, or 0.19%, to Rs 76,833 per 10 grams. Meanwhile, silver for March delivery increased by Rs 1,251, or 1.38%, to Rs 92,061 per kg.

Around the world, Comex gold futures rose by $7.40, or 0.28%, reaching $2,665.90 per ounce. Just the day before, gold and silver prices were highly influenced by a stronger dollar after U.S. President Donald Trump threatened to impose heavy tariffs on BRICS countries. This news worried traders and pushed the dollar up, also causing the Indian rupee to weaken significantly.

Gold’s safe demand was affected by signs of a hold in the Israel-Hezbollah ceasefire, but tensions between Russia and Ukraine still encouraged some buying of gold. Chintan Mehta, the CEO of Abans Holdings, mentioned that gold prices stayed steady because of better-than-expected U.S. manufacturing PMI data, which helped boost the dollar’s strength. He also noted that Christopher Waller, a U.S. Federal Reserve governor, is still hopeful about falling inflation and a strong job market, hinting at possible interest rate cuts in December.

In the Asian market, silver is trading 1.93% higher at $31.46 per ounce.

-

Amagi Acquires Argoid AI to Revolutionize Streaming Services

Amagi, a successful tech company based in Bangalore, has just bought Argoid AI, a company that specializes in using artificial intelligence (AI) to help streaming services recommend shows and schedule content automatically. This acquisition will help Amagi provide smarter tools for media companies to plan, share, and earn money from their content.

Argoid AI is famous for creating advanced AI tools that make finding and watching content easier for viewers. By combining their technology with Amagi’s existing services—like Amagi NOW and CLOUDPORT—Amagi hopes to offer better, faster, and more personalized choices for media companies.

Baskar Subramanian, Amagi’s CEO, said, “We’re excited to use Argoid’s AI technology to make our cloud solutions even better for our customers.” Together, the two companies plan to tackle common challenges in streaming, such as helping viewers find the content they want and keeping them engaged.

The deal brings Argoid AI’s talented engineers and creators into Amagi. The founders—Gokul Muralidharan, Soundararajan Velu, and Chackaravarthy E—will help guide the future direction of Amagi’s technology. Gokul Muralidharan stated, “We’re excited to join Amagi, a leader in media technology. This partnership will help us deliver even better solutions for our customers.”

Amagi helps various famous brands like A+E Networks UK, NBCUniversal, and more to create, distribute, and profit from their channels more easily.

-

Stock Market Update: Nifty Drops, Sensex Rises with Key Movers

NEW DELHI: Today, several stocks hit their lowest prices in a year, including Aki India, C.E. Info Systems, Dhanvarsha Finvest, Akshar Spintex, and GIR Natureview. The main stock market index, NSE Nifty, dropped by 181.11 points, finishing at 24,457.15. However, the BSE Sensex saw a nice rise, closing up by 597.67 points at 80,845.75.

On a positive note, some stocks reached new highs today. These include Madhav Copper, BSL Ltd, Enviro Infra Engineering, Dharamsi Morarji, and Banaras Beads. Among the winners in the Nifty 50 index were Adani Ports SEZ, NTPC, Adani Enterprises, L&T, and SBI.

However, not all stocks performed well. Top losers today were Bharti Airtel, Hero MotoCorp, ITC, HDFC Life, and Sun Pharma.