On Tuesday, the Congress party took action by asking the Supreme Court to review some new changes made to the rules of elections. They believe these changes are harming the trust people have in elections. The government updated certain rules, which now make it harder for people to see important documents, like video recordings from CCTV cameras or candidate videos.

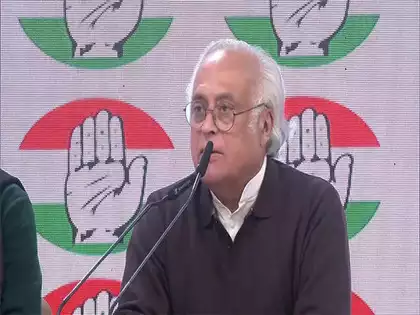

Jairam Ramesh, a leader in the Congress party, shared his concerns online, stating that the trust in elections is declining quickly and hopes the Supreme Court will help fix it. He mentioned that the Election Commission, which is responsible for ensuring elections are fair, should not make such important changes without talking to the public. He emphasized that these changes limit people’s access to essential information that keeps elections transparent and accountable. Recently, the Union law ministry, based on suggestions from the Election Commission of India, changed Rule 93(2)(a) of the election rules to restrict public access to some important documents.