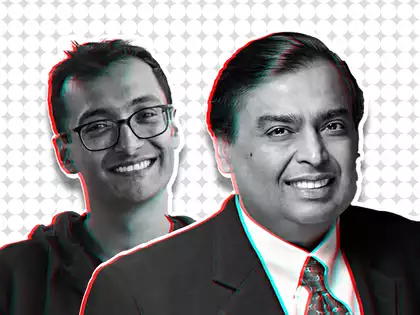

In January 2022, Dunzo seemed unstoppable after raising $240 million, mostly from Reliance Retail. They promised to deliver groceries to many people in India in just 15 minutes. Fast forward to now, and the last founder, Kabeer Biswas, has left Dunzo, marking a big change for a company that led India’s fast delivery movement.

The Trouble Starts

After raising a lot of money in 2022, Dunzo expanded quickly, focusing on their 15-20 minute grocery delivery service called Dunzo Daily. Unfortunately, this led to high expenses of over Rs 100 crore every month. They spent heavily on marketing and IPL sponsorships, which increased business but burned a lot of cash. Despite trying to grow, people still saw Dunzo mostly as a delivery service and not as a quick grocery provider.

As their money ran low and getting new funds became hard, they changed their delivery time promise from 15 minutes to 60 minutes to save costs. By mid-2023, the investment environment in India had worsened, and things got tough for Dunzo.

Failed Deals and Mergers

A potential investment from PhonePe in Dunzo’s business didn’t happen because other investors were worried. An offer from Flipkart to buy Dunzo also fell through because investors didn’t want to lose the Dunzo brand. Even Reliance, which owned a part of Dunzo, didn’t want to invest more money. Dunzo tried to raise funds by offering shares at a much lower price, showing their financial struggles.

Trying to expand from seven cities to 15-16 cities was a critical mistake. They were already having problems in their current markets, but they chose to grow even more.

The Company Falls Apart

A late decision to focus more on Bengaluru and Pune came too late. Companies like Swiggy Instamart and Zepto had already taken over the market. Dunzo also lost five board members, including two of the founders. Employees faced delayed salaries, leading to layoffs as financial pressure grew.

In FY23, Dunzo’s losses tripled to over Rs 1,800 crore, while revenue increased to Rs 226 crore. Their B2B efforts and partnerships didn’t solve their cash flow problems. Even an attempt to secure $20 million from existing investors failed.

What’s Next?

Over its 10 years, Dunzo focused too much on rapid growth to impress investors, often ignoring sustainable business practices. They raised a total of $450 million but were valued at just $745 million, with big names like Google and Reliance among their investors.

Dunzo spent a lot on marketing and growth strategies that didn’t provide long-lasting value, which became a big problem when it was hard to find new investments. With rising debts of around $60 million and several ongoing legal cases, Dunzo lost the trust of investors.

Kabeer Biswas’s departure marks a tough end for a company that once showed great promise in India’s delivery market.

Leave a Reply