This week, Indian stock markets continued to climb. The Nifty50 went up by 1.3% and the Sensex increased by 1.6%. However, the broader markets took a bit of a break after doing well last week. The BSE Midcap index slightly rose by 0.4%, but the Smallcap index dropped by 1.3%.

On Friday, the BSE Sensex went up by 259.75 points, or 0.32%, closing at 80,502 points. Meanwhile, the Nifty50 finished at 24,346.70, gaining just 12.50 points, or 0.05%.

Nagaraj Shetti, a Senior Technical Research Analyst at HDFC Securities, noted that a small upward candle appeared on the daily chart, indicating that the market might be trying to break through the 24,500–24,600 barrier. However, the presence of resistance could lead to more ups and downs.

If the Nifty crosses 24,500–24,600, it could maybe rise further to 24,800–25,000. But if it drops, support may be found around 24,000–23,800.

Key Market Influences This Week:

1. Fed Meeting: Investors will look at the outcome of the Federal Reserve meeting on May 7. Decisions on interest rates can affect market feelings.

2. Q4 Earnings: Earnings reports for Q4 FY25 will begin next week. People will pay attention to results from SBI and Kotak Mahindra Bank, which reported earnings on Saturday.

3. Macroeconomic Data: The April 2025 HSBC Services PMI will be important to watch. In the US, people will focus on the April S&P Global Services PMI, March Balance of Trade, and weekly jobless claims.

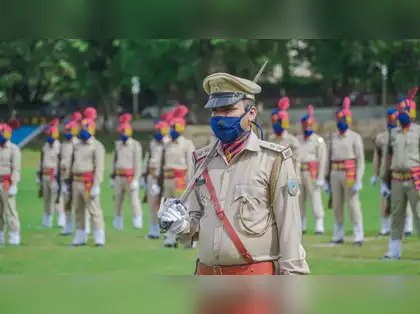

4. India-Pakistan Tensions: Increasing tensions along the Line of Control (LoC) could make investors nervous and may lead them to seek safer investments.

5. Technical Factors: According to SBI Securities, significant resistance for the Nifty is at 24,540. If it breaks through, it could reach 24,800 and then 25,200. The immediate support is at 24,200, and if it goes below this, the next support could be at 23,850.

6. FII Activity: Foreign and domestic institutional investors were net buyers this week, with Rs 10,071 crore and Rs 9,270 crore in purchases, respectively.

7. Crude Oil Movement: Brent crude oil saw its biggest monthly drop since November 2021, falling 15.2% due to too much supply. However, prices bounced back to $62 per barrel after the US threatened sanctions on Iran.

8. Rupee/Dollar Movement: The Indian Rupee went up by 1.06% this week, crossing the 84-per-dollar mark for the first time since October 2024.

Leave a Reply