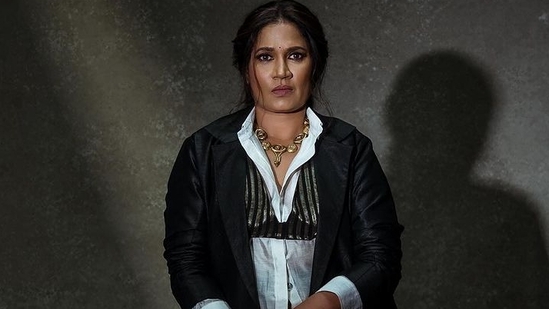

Nani’s new movie, HIT: The Third Case, is getting a lot of attention after its exciting trailer was released. This thriller is packed with mystery, action, and hard-hitting dialogues that fans are sure to love. In this film, Nani stars alongside actress Srinidhi Shetty.

The movie is set to hit theaters on May 1. Early ticket sales in the United States are looking promising, with reports showing that HIT 3 has raised $415,976 from advance ticket sales for the premiere. In just one day, ticket sales jumped by 55%, with about 21,500 tickets sold at 435 locations.

So far, HIT 3 has made a total of $450,000 in pre-sales in the U.S., making it the second-highest Telugu movie for advance bookings this year, just behind Ram Charan’s Game Changer. Analysts believe that the final pre-sale numbers could soar to between $650,000 and $700,000, and they expect great performance in North America.

However, HIT 3 will face competition at the box office with other films releasing on May 1. These include Ajay Devgn’s Raid 2 and Suriya’s Retro, plus the new Marvel movie, Thunderbolts. Despite the competition, Suriya has sent his best wishes to both Raid 2 and HIT 3, and Nani responded back, saying he’s looking forward to watching Retro.

What’s HIT 3 About?

The movie follows Arjun Sarkaar, a cop with a dark past and a bit of a temper. He’s part of the Homicide Intervention Team (HIT) and takes on a case involving missing children. The story promises to deliver plenty of excitement, suspense, and intense action.

Leave a Reply