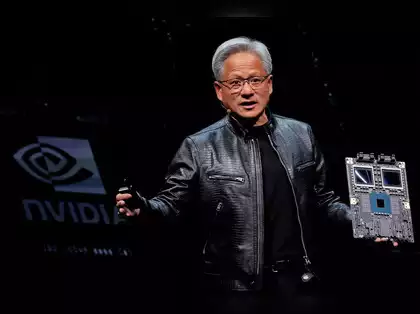

Jensen Huang, the CEO of Nvidia, is one of the richest people in the U.S., with a fortune of $127 billion. When he dies, he should pay a 40% tax on his wealth, which means billions would go to the government. However, Huang has found clever ways to avoid much of this tax, allowing his family to keep around $8 billion. This is part of a trend where very wealthy people use complicated tax strategies to protect their money from taxes meant for estates.

The estate tax, which only affects a small number of very rich people, hasn’t produced much revenue for the government in the last two decades, even though the wealth of the richest increased a lot. In 2000, if the estate tax had grown with overall wealth, it could have brought in around $120 billion last year, but instead, it only raised about a quarter of that amount.

Huang’s tax avoiding methods include using special types of trusts that let him move millions of Nvidia shares into a safe place. For example, in 2012, he put around 584,000 Nvidia shares worth $7 million into a trust. Today, those shares are worth over $3 billion, but rather than paying a huge tax on that, his family will likely owe only a few hundred thousand dollars.

In 2016, Huang set up more trusts with even more Nvidia shares. Those shares are now worth over $15 billion. This will save his family about $6 billion in estate taxes when he dies. If he sells shares from these trusts, he will face a large capital gains tax, but he can cover that bill without it being taxable to his heirs.

Additionally, Huang has used his charitable foundation to donate Nvidia shares, which have reduced his taxable income, allowing him to save even more money. Since his foundation has funneled a lot of money into a donor-advised fund (where he still has some control), it means his family can avoid paying estate taxes when he passes away. In recent years, 84% of the foundation’s donations went to this fund. The shares donated have significantly reduced his potential estate tax, saving his family up to $800 million.

Leave a Reply