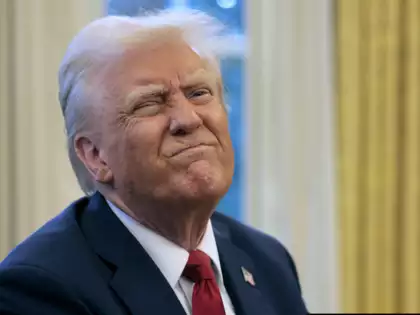

President Donald Trump is taking big steps to change how countries tax and regulate trade, which could shake up the world economy. On Thursday, he instructed his top economic team to think about new US tariffs (taxes on imported goods) based on how much other countries’ tariffs and rules hurt US exports. These new “reciprocal” tariffs will be different for each country and will target those with whom the US has the biggest trade deficits.

Trump said, “The numbers are going to be very fair but staggering. They’re going to be large.” This new plan replaces his earlier idea of a single tariff for all countries, putting the European Union, China, India, Mexico, and Vietnam on notice.

European Commission President Ursula von der Leyen criticized Trump’s plan as harmful to Americans because it raises costs and could slow down economic growth. Other countries were quick to react; Indian Prime Minister Narendra Modi announced they would begin trade talks with the US, while Japan and Taiwan expressed interest in strengthening ties with America.

If Trump’s new rules are put in place, it will change how the US has handled tariffs for nearly a century and could upset established international trading rules. Until now, countries typically helped each other by keeping tariffs low; Trump’s plan flips this idea by seeking high tariffs against certain countries.

Trump’s advisors believe this change is necessary. For example, they argue that value-added taxes (VAT)—a tax many countries use—give foreign companies an unfair advantage. Over 160 countries use these taxes, while the US taxes income instead. Trump claimed, “A VAT tax is a tariff,” but many economists disagree, saying VAT applies equally to domestic and foreign products.

Economic experts worry that adding VAT to existing tariffs could increase US tariffs significantly, possibly leading to US inflation rising to around 4%. Some countries affected most would be India, Brazil, and those in the EU.

Trump’s focus on VAT reignites an old trade conflict with Europe about how these taxes are handled. The US and EU have argued about VAT rules since the 1960s. Experts like Erica York from the Tax Foundation explain that VAT does not discriminate against foreign goods.

The new approach could lead to complications and backlash against the US, with former trade officials warning that trying to dictate other countries’ tax rules could create resentment. Jennifer Hillman noted, “We’re just going to make America hated again,” emphasizing how other nations might react to US interference.

In summary, Trump’s changes could lead to higher prices for Americans and complicated trade relationships.

Leave a Reply