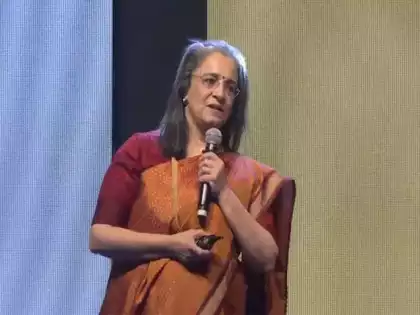

Madhabi Puri Buch, the head of SEBI (the Securities and Exchange Board of India), recently warned that some companies are misusing money they raise from IPOs (Initial Public Offerings). She asked investment bankers not to help these companies enter the stock market.

Buch mentioned that they have discovered serious problems where companies bring in money but then mismanage it. For example, some companies are using tricky methods to shift these funds to other places, including overseas, under false pretenses, like saying they are purchasing apps or software.

During a meeting with investment bankers in India, Buch explained that there are clear signs that a company might be involved in bad practices, like paying investment bankers high fees or not having enough staff. She noted that some companies get a lot of attention during their IPO, but then the owners quickly sell their shares to make a fast profit.

Buch compared SEBI’s role to that of a doctor. She said that while Indian markets are following the rules, there need to be more efforts to genuinely understand and embrace them. She emphasized that many companies are setting good examples by having strong corporate governance.

A new generation of business owners is more focused on doing the right thing and less on taking risks, unlike their parents. She also mentioned that SEBI is paying more attention to potential wrongdoing, which helps to keep companies honest. However, she noted that many whistleblowers only come forward when it is convenient, rather than at the moment they see something wrong.

Buch believes that businesses with good governance will be rewarded in the market. She is hopeful that more companies will improve their governance in the future.

In terms of technology, SEBI is improving how it reviews IPO documents. They have developed a tool that checks these documents for compliance and flags any issues. This helps SEBI process almost all IPO applications within three months. Buch also pointed out that the workload from investment bankers is expected to rise, with around 1,000 IPOs planned in the next two years.

Leave a Reply