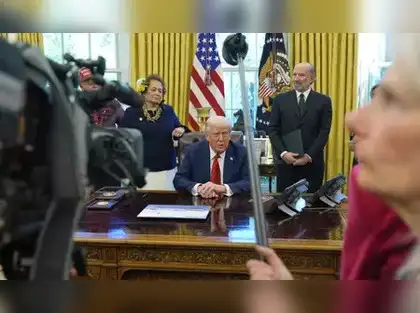

This week, Donald Trump expressed his frustration with the US Federal Reserve (often called the Fed), which is the country’s central bank. He threatened to fire Jerome Powell, the leader of the Fed, if he doesn’t lower interest rates as Trump wants. Lowering rates is something Trump believes would help the economy while he implements new tariffs on imports.

However, Powell, whose job lasts until May 2026, is unlikely to resign. He stated that he believes the Fed’s independence from political pressure is very important. Experts agree that Trump’s tariffs could actually lead to higher prices and slow down economic growth, which might prevent the Fed from cutting rates anytime soon.

Economists like Stephanie Roth pointed out that just because Trump wants rate cuts doesn’t mean the Fed will agree; if they did, it could be harmful to the U.S. economy.

The independence of the Fed is very important. Countries without such independence often have weaker currencies and higher interest rates. Mark Zandi, another economist, highlighted the dangers of interfering with the Fed’s independence, noting that it could lead to a troubled economy.

There’s also an ongoing case that might give Trump the ability to fire Fed leaders. However, many legal experts say he doesn’t have that power right now. If Trump’s actions harm the Fed’s reputation, it could lead to higher interest rates and troubles for the government.

In the past few weeks, as Trump’s tariffs were announced, U.S. government bond prices have fluctuated. This shows that investors are worried about the country’s stability as a safe investment. If people feel the Fed can’t control inflation, bond yields (which determine how much interest investors earn) could rise. In the end, many agree that a strong, independent Fed is crucial for a healthy economy.

Trump’s Threat to the Fed: The Risks of Political Pressure on the Economy

Leave a Reply