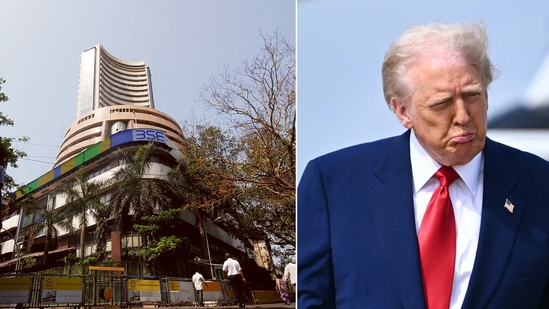

On Monday, Indian stock markets suffered a major fall, making many investors very nervous. This was mainly because U.S. President Donald Trump announced new taxes, called tariffs, on goods coming from all countries. This news made people fear that a global trade war might be on the horizon.

When the markets opened on Monday, the Sensex and Nifty indices dropped almost 5%. In early trading, the Sensex went down by about 3,940 points to settle at 71,425, while the Nifty fell by around 1,160 points to reach 21,743.

Companies that rely heavily on business from the U.S. were hit the hardest. Tata Steel’s shares fell by over 8%, while Tata Motors saw its shares drop by more than 7%. Other tech giants like HCL Technologies, Infosys, and Reliance Industries also faced massive losses.

This market crash is the worst we’ve seen since the COVID-19 pandemic began.

Why is This Happening?

The fear began when Trump announced tariffs, which sparked concerns of a trade war as countries like China and Canada considered retaliatory measures. Investors are worried that this could trigger a global recession, leading to less economic growth.

In Asia, markets like those in China and Japan fell by 10% and 8%, respectively. In the U.S., the S&P 500 index dropped by 6%, and the Dow Jones lost over 2,000 points during its worst week since the COVID-19 crisis.

Experts believe that higher tariffs may lead to increased prices for things like food and cars, which could hurt company profits. U.S. companies are about to report their earnings, and analysts at Goldman Sachs warn we might hear fewer companies giving positive forecasts than usual.

The head of the Federal Reserve, Jerome Powell, said that the impact of Trump’s tariffs will likely affect both inflation and economic growth, creating worry about the U.S. economy’s future.

As the situation continues to unfold, the Nasdaq index recently confirmed it’s in a bear market, showing that the downturn is far from over.

Leave a Reply